That time I put my (financial) foot in my mouth

So here I am, shouting from the mountain top that I bought a brand new car, got a great deal, and I’m happy with this new “quality of life” that my purchase has brought. These sentiments all still remain true, of course.

When I purchased the car a few months back, I figured that “something” would happen to the new car eventually, like a hot coffee spilling, a kid barfing in the backseat, or a hamster nesting in some dark corner. I think it’s inevitable, and this expectation has helped me appreciate the newness of the car while I have it. I did not, however, expect something to happen so soon (4 months!) after the purchase, nor did I expect the extent of the damage to be as brutal as it was.

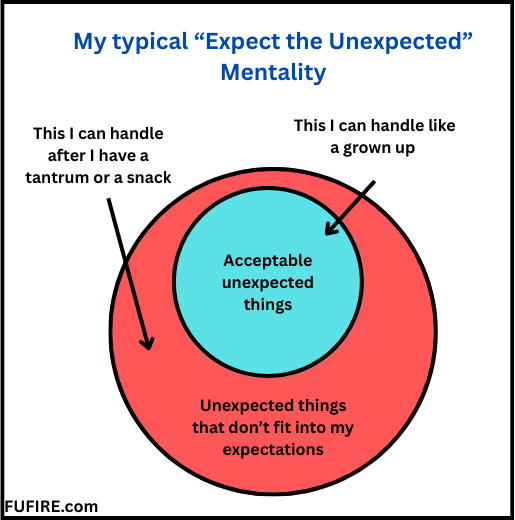

Turns out, I am okay with the unexpected, as long as it stays within certain parameters. This “unexpected” scenario came way out of left field.

What happened, you may wonder?

Upon return from a short vacation this holiday, we discovered that the sudden and swift, wild winds of a rainstorm had sent our sun shade, and its metal attachment, mercilessly dancing all over my car, over and over, for who knows how many hours. Dent upon dent, chipped paint upon dents, and panels punctured all around the shiny, new, sparkly exterior. Every part of the car, except the hood, has been damaged.

At the discovery of this, I didn’t shed one tear, nor get upset at the humbling display of strength from Mother Nature. A light snack later, I continued to ponder my situation. I was surprised at my own callused reaction, and I have been trying to understand why I took it in stride, when other, smaller problems in life cause a much stronger response.

Was I expecting something to happen because this was a superfluous purchase, and perhaps this is my punishment?

…Not really.

I’m certainly not excited about this new “to do” issue to deal with. I realized, though, when I bought this car and liked it as much as I did, I knew there was a risk. Buying something nice, and maintaining it, takes up more time and mental bandwidth.

This same thinking occurred when I purchased YoungFUnds new bike; they needed a bigger bike, and I spent a few more bucks on one that had colors they preferred, and would get them more excited about riding it around with friends. Now that they have it, I find myself more paranoid that it’s locked up, and that it doesn’t get scratched nor beat up too much.

Buying something nice, whether a bike or a car or a piece of clothing, also means it can get damaged, and would need upkeep over time to maintain the level of quality I want it to have. This bandwidth is the price I knew I would likely need to pay someday, especially for a car that has to endure the outside elements.

I think this emotional response, or lack thereof, is not a sign that I don’t appreciate what I have.

I think it’s a matter of accepting the responsibility I took on when I bought something new with a few bells and whistles.

A Good News/Bad News of the situation is that (Good News!) my car insurance will cover this. The (Bad News!) is that I’ve been paying car insurance for 20 something years, and this is the first time I’m using it. Not exactly a great return on my money, but also not much of a choice when it comes to driving in California.

My conversation with YoungFUnd went something like this:

Ms. FUnds: Guess how much the paint and replacement parts for my car is going to be?

YoungFUnd: Ummm a hundred dollars!

Ms. FUnds: Nope, it might be TEN THOUSAND DOLLARS!

YoungFUnd: You have to PAY all that?

Ms.FUnds: Well, I have been paying for insurance, and they will pay for the repairs.

YoungFUnd: Sounds like you’ve already paid for it, then.

Ms.FUnds: Yup.

This conversation with YoungFUnd reminds me of a classic article from Mr. Money Mustache, titled Insurance: A Tax on People Who are Bad At Math? The ballpark estimate of my car repairs will be $9,000 to $11,000, and 3 weeks of a rental car. I’ll be dropping it off next week for the official estimate. While my insurance has GENEROUSLY accepted the claim (sarcasm much?), I think about how much I have spent each month on car insurance. I compare it to how much it would be over time if it was invested instead of spent on insurance, and I try not to cry. Yes, there is liability, catastrophic collision, and plenty of other things that insurance can protect me from financially, but so much of it is so unlikely, I can’t help but wonder, and plug some numbers into the calculator anyways.

Soon I will be relinquishing my golf-ball patterned car to the auto body shop, and I will be cruising around in a rental for a while. Hopefully I get my car back in one smooth piece. In addition, this little lesson of mine will stay with me in the future, next time I am considering adding something “nice” to my life that serves more than the basic functions or necessities.

Maybe next time I should just borrow my kid’s bike.