My Retirement Plan(ish)

So how does an anxious, black and white thinking, all or nothing goal maker create an early retirement plan without organizing themselves into a corner (or off a cliff)?

Well, I initially attempted to over plan the perfect escape from my career, in an effort to make sure it would be an iron clad guarantee. I learned about the pros and cons of each retirement strategy I could set up, plugged each scenario into the retirement calculators, and then re-submitted each one with a different tweak to see the impact.

The trouble with finding the “perfect” plan, at least for me, was trying to follow the damn thing. In a vacuum, the steps to follow year after year are simple. But if I step away from the excel sheet and firecalc.com and wait about 5 seconds, that’s when it all goes awry. As I’ve talked about in My Story, I’ve learned to let go of rigid planning, and move towards an early retirement with an open mind during each step.

Just a friendly reminder- I am not a financial advisor, and this is just my (potential!) personal plan. Everyone has their own set of circumstances and there is never a one-size-fits-all poster.

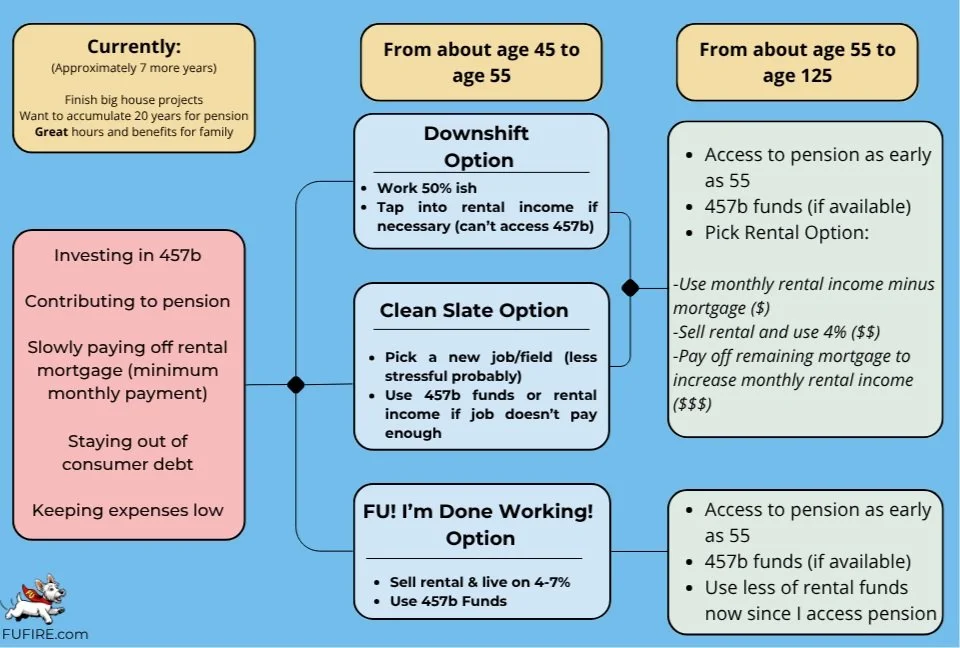

The outline below is an end product that originally started out as an overzealous rigid plan, then finally arrived as a reality-induced “guide”. In this general outline, opportunities and unknowns are welcomed.

So that’s it. That’s the most I’ll allow myself to plan, in an effort to allow other opportunities in life to pop up. When I first came across financial independence, I read so many stories of couples that planned for their early retirement in a very rigid way, on a single path. They were successful, and are now financially independent.

Given my circumstances and personality, however, I know my quality of life is better if I am working towards some options.

I think of it this way; Would I type in a cross-country road trip destination into Google Maps, and stick to the route no matter what? Especially with a kid in the car?

This Retirement Plan(ish) helps me visualize where I can deploy my money, depending on my age, and depending on the circumstances. There comes a point, though, where analysis paralysis can set in, and stop any forward movement with any plan. Or, worst of all, stop me from having an open mind for the future. Even with a ton of “What if’s?” swirling through my mind, I charge forward with my Retirement Plan(ish), knowing that it has flexibility in what my needs will be at the time.

The “What if’s?” and unknowns will sort themselves out as I get further along, and I can make more informed decisions when more information is available, as the need arises.

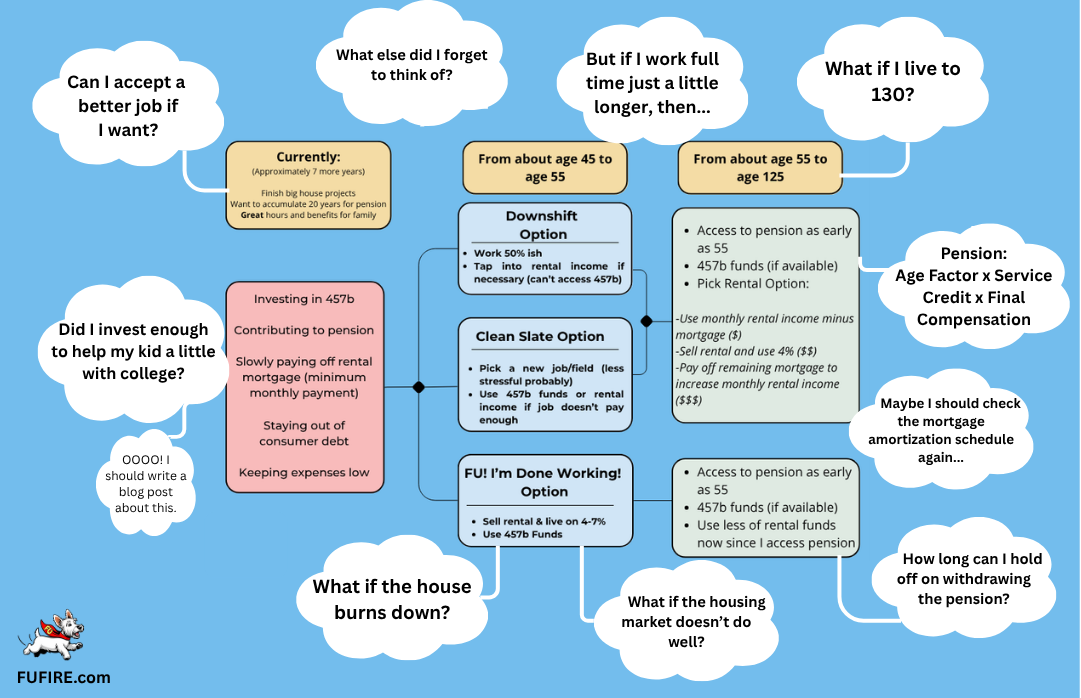

Even now, as a recovering over planner, I don’t actually stop my concerns or thoughts that come up with my future options.

I just have recognized that I won’t benefit from taking every little “What if!?!?” and accommodating it.

As an example, here is a tiny peek into the inner workings of my thought process when I look at my little plan. Brace yourself!

Just looking at this image, I can think of 10 more “What Ifs” to add.

There is no single plan that can factor in all the variables that life brings my way. Even if I were to create a rigid plan, it won’t be disruption-proof. So I breathe a sigh of relief now when I think about how I have created multiple off ramps for myself, and I welcome other unknowns that may come up.

Most importantly, it affords me flexibility to make the decision on my own terms, when I decide it’s time to make a change.

The painful truth is, the longer I wait to make any move, the more money I’ll have. The “safer” I’ll be. At some point, I’m not sure when, enough will be enough and the time to make a change will arrive. I don’t know when that will be, nor what the circumstances will be when it’s my moment to make a change. I have learned this is a positive unknown.

I wonder, when it comes to people who plan to retire early, are they focusing on a single path? Or are they also working towards options, and staying flexible with the direction life may take them? I’ve read so many different journeys, heard such varied strategies, and seen success for so many.

The best thing I can do for myself right now is enjoy the ride, and savor my memories with the people I love around me. The best thing I can do for future me is to keep shoveling funds into my 457b, and try not to burn the house down.

I should be able to handle that…